DeltaFX is one of the most known and well-established brokers around the globe and has been active in the Forex market for the past sixteen years. DeltaFX has managed to win numerous awards over the years, including the Market Leader Award in 2024, The award for the best broker in the world from the trader point of view in 2022, The award for the best IB service provider in 2022, the award for the best broker in terms of trader service in 2021, the award for the best forex broker in the Middle East region in 2021, the award for the best broker in terms of user experience in 2021, the award for the most influential broker in the financial markets in 2021, the award for the most reliable broker in the world from the experts point of view in 2021, and the award for the most influential figure in the financial markets in 2022 among many others.

Client needs and customer satisfaction are crucial leading principles for DeltaFX. DeltaFX has always strived to achieve excellence in customer service and has attempted to pave the way for its esteemed clients. With this goal, DeltaFX has created four types of accounts to meet the needs of every level of traders and offer the best services possible regarding their needs and requirements. In the following article, we will discuss DeltaFX’s various accounts.

What Is A Trading Account?

A trading account is a financial account through which investors can buy and sell various financial instruments such as stocks, bonds, commodities, foreign exchange, or derivatives. As a rule, it is opened by an individual or institution with the aim of performing active trades in the financial markets. Here’s precisely what a trading account is, along with the pivotal components defining it:

Core Features of a Trading Account:

- Facilitates Buying and Selling:

A trading account is basically a place where one can conduct trades in the financial markets. This directly connects with the stock exchange for buying and selling orders that an investor wants to place.

- Associated with Broker:

Trading accounts are usually associated with brokers. You open an account with a broker in order to trade. This broker is in between you and the financial market.

- Add Fund:

You deposit money into the trading account from your bank account. The balance is used to buy financial securities. Upon liquidation, the funds are returned to the account, and the made or incurred profit/loss can be withdrawn.

- Real-Time Market Access:

Most trading accounts give traders access to live market data to make real-time decisions based on the asset’s current price.

How It Works:

- Add Funds: You deposit money into a trading account.

- Place Orders: You buy and sell financial instruments through a broker or an online platform.

- Monitor Positions: When trades are filled, you will be able to track your portfolio and monitor the performance of your holdings.

- Withdraw Profits: You will be allowed to withdraw your profits or take your losses to your bank account after selling the assets.

Quite simply, any investor looking to be active in the financial markets needs a trading account. It provides a direct channel through which he may approach the markets and manage his investment portfolio.

With regard to trading accounts, DeltaFX has created four types of trading: the standard account, the Nano account, the Fix-Spread account, and the ECN account.

In the following, we will provide a detailed recount of each account.

The Standard Account

This account is perfect for basically all traders with every level of experience. This account provides the most trading symbols and trading symbols. This account has a floating spread and no slippage.

- Trading platform: MT4 & MT5

- Account Currency: USD

- Leverage: Up To 1-400

- Max Deposit: Unlimited

- Min Deposit: 50 USD

- Commission: No

- Order Execution: Instant

- Spread: Floating

- Margin Call: 100 %

- Stop Out: 20 %

- Swap Free: YES

- Limit & Stop Level: 0

- Trading Instrument: Forex, Metal, Energy, CFD Index, Shares, Cryptocurrency

- Contract Size: Standard

- Trade Size: 0.01

- Slippage: No

- Personal Support: YES

The Fix-Spread Account

Trade expenses are lowered in the fixed spread account (Fix Spread) since the spread is fixed. Furthermore, it is possible to anticipate how trade costs will be calculated.

- Trading Platform: MT4

- Account Currency: USD

- Leverage: Up To 1-400

- Max Deposit: Unlimited

- Min Deposit: 100 USD

- Commission: NO

- Order Execution: Market

- Spread: Fix

- Margin Call: 100 %

- Stop Out: 20 %

- Swap Free: YES

- Limit & Stop Level: 2 * Spread

- Trading Instrument: FOREX, Metal, Energy

- Contract Size: Standard

- Trade Size: 0.01

- Slippage: YES

The ECN Account

The ECN account allows buyers and sellers to communicate directly, cutting away any middlemen, which significantly speeds up transactions. Professionals, especially scalpers, should use an ECN account because of its minimal commission, spread, and quick transaction execution.

- Trading Platform: MT4

- Account Currency: USD

- Leverage: Up To 1-200

- Max Deposit: Unlimited

- Min Deposit: 200 USD

- Commission: Yes

- Order Execution: Market

- Spread: Floating

- Margin Call: 100 %

- Stop Out: 50 %

- Swap Free: YES

- Limit & Stop Level: 60

- Trading Instrument: FOREX, Metal

- Contract Size: Standard

- Trade Size: 0.01

- Slippage: YES

Alt: ECN Account

The Nano Account

Novice traders and those looking to enter the market with modest funds are the target audience for this account. With just a $10 deposit, you can open a Nano trading account.

- Trading platform: MT4 & MT5

- Account Currency: USD

- Leverage: Up To 1-1000

- Max Deposit: 1000 USD

- Min Deposit: 10 USD

- Commission: NO

- Order Execution: Instant

- Spread: Floating

- Margin Call: 100 %

- Stop Out: 20 %

- Swap Free: YES

- Limit & Stop Level: Average 65

- Trading Instrument: FOREX – GOLD

- Contract Size: 0.1 Standard

- Trade Size: 0.001

- Slippage: No

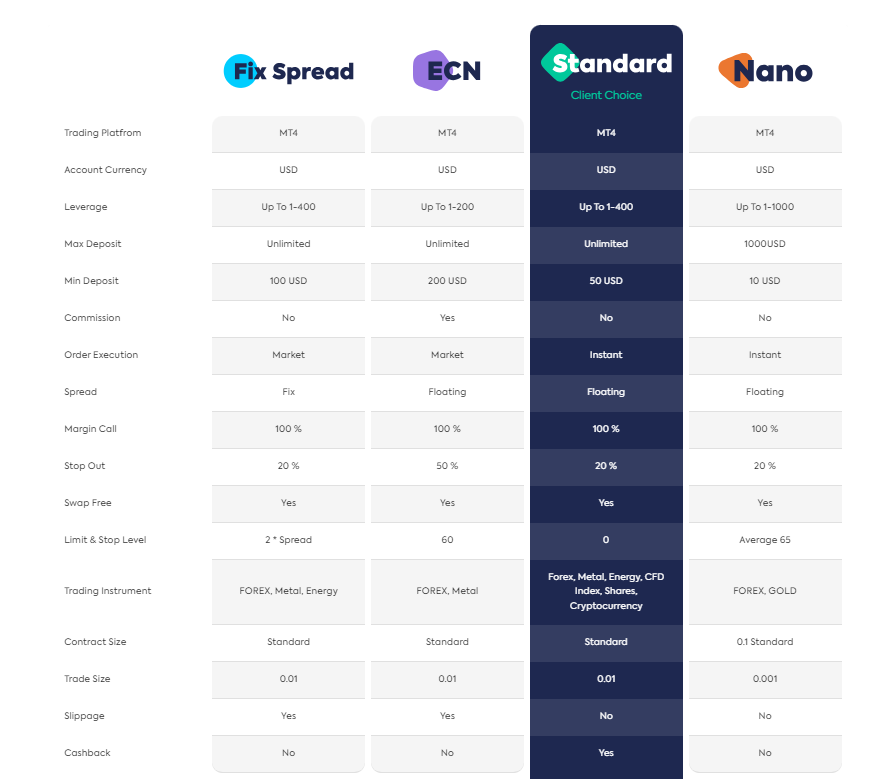

Account Comparison in A Glance

In the picture below, you are provided with a comparison of the accounts.

The Concluding Remarks

DeltaFX offers four different types of accounts that can essentially meet the needs of every level of traders. These accounts include standard, ECN, Nano, Fix-spread and ECN. Each account has its own unique characteristics, which may be helpful to traders. To find more information about the account, kindly visit DeltaFX.com.